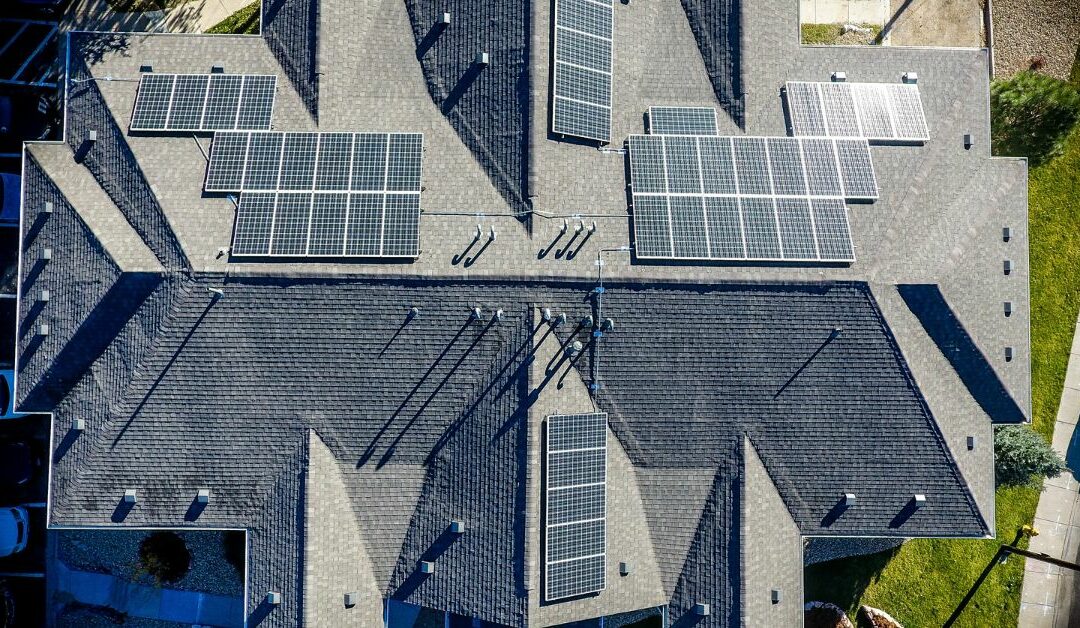

If you’ve been considering solar panels, geothermal heat pumps, or other clean energy upgrades, 2025 might be your last real opportunity to claim the full 30% federal Residential Clean Energy Credit (RCEC).

Originally set to phase out gradually through 2034, this powerful incentive is now being cut short under the new “One Big Beautiful Bill” tax legislation.

Here's what homeowners and renters need to know.

The 30% Credit Is Still Available—But Not for Long

The Residential Clean Energy Credit allows you to deduct 30% of qualifying clean energy costs from your federal tax liability. This includes not just solar panels, but also:

- Geothermal heat pumps

- Solar water heaters

- Small wind turbines

- Battery storage and other clean energy systems

But here’s the catch:

- You must have the system installed and placed in service by December 31, 2025

- If you miss the deadline—even by a day—you could lose the entire credit

- The credit applies to both homeowners and renters, as long as you live in the home

Why This Matters for Your Tax Planning

This isn’t just about going green—it’s about using the tax code to your advantage.

While the 30% credit can significantly reduce your federal tax bill, it’s important to know:

- The credit is non-refundable—meaning it can’t increase your refund beyond what you owe

- However, unused portions can be carried forward to offset future tax bills

If you're thinking of making a clean energy upgrade in 2025, now is the time to act—before the window closes.

Want to Know How This Affects Your Return?

If you're unsure how to apply the credit, whether you qualify, or how to time your upgrade for maximum benefit, let’s talk.

Email me at kim@kimberlybagleycpa.com or book a call with me here to make sure your clean energy investment is a smart tax move—not a missed opportunity.