Big changes are coming in 2025—and the new “One Big Beautiful Bill” tax law is packed with updates that could impact nearly every type of taxpayer. Whether you're an employee, business owner, investor, parent, or retiree, there are new ways to save… and new rules to...

Big changes are coming in 2025—and the new “One Big Beautiful Bill” tax law is packed with updates that could impact nearly every type of taxpayer. Whether you're an employee, business owner, investor, parent, or retiree, there are new ways to save… and new rules to...

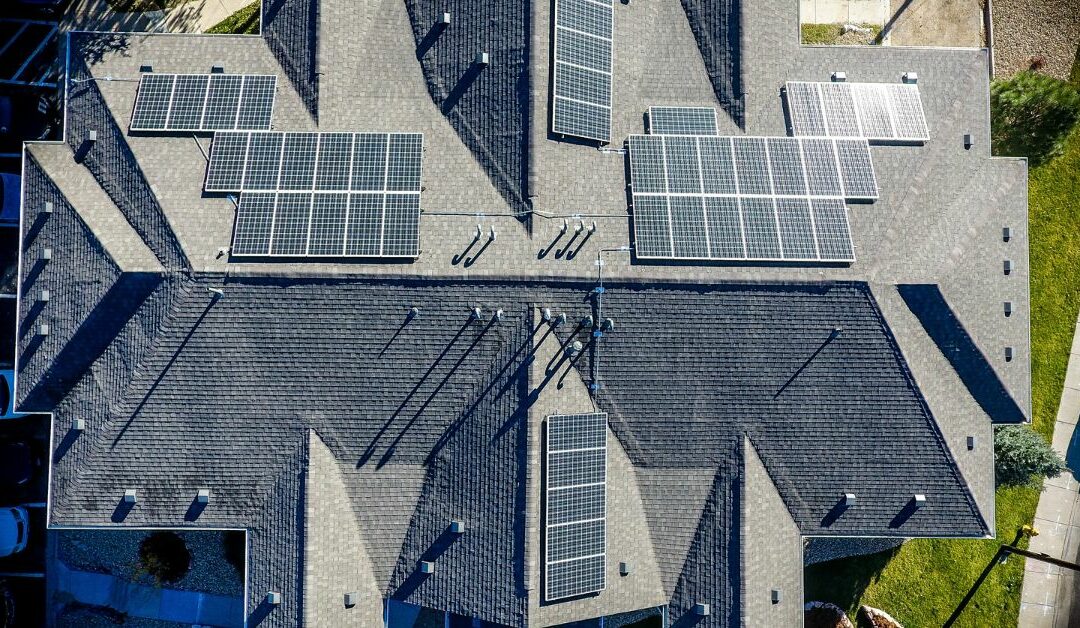

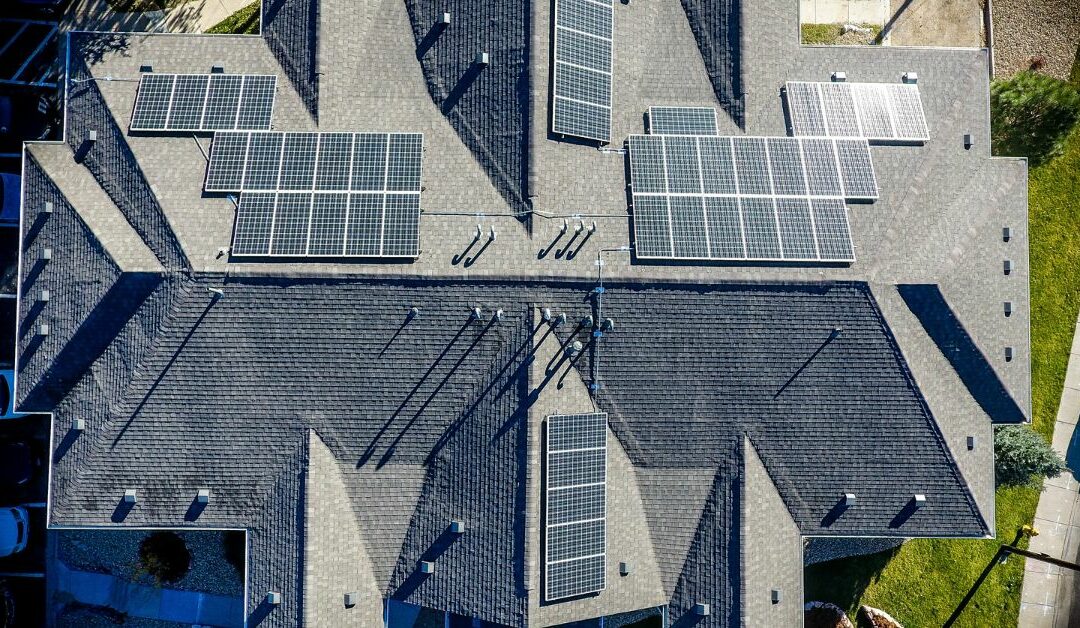

If you’ve been considering solar panels, geothermal heat pumps, or other clean energy upgrades, 2025 might be your last real opportunity to claim the full 30% federal Residential Clean Energy Credit (RCEC). Originally set to phase out gradually through 2034, this...

If you’ve been considering solar panels, geothermal heat pumps, or other clean energy upgrades, 2025 might be your last real opportunity to claim the full 30% federal Residential Clean Energy Credit (RCEC). Originally set to phase out gradually through 2034, this...

If you're currently in school, just starting your career, or learning a trade, there’s good news: the tax code may be able to lighten your financial load—if you know how to use it. The 2025 updates include some important opportunities (and a few potential risks) for...

If you're currently in school, just starting your career, or learning a trade, there’s good news: the tax code may be able to lighten your financial load—if you know how to use it. The 2025 updates include some important opportunities (and a few potential risks) for...

Health Savings Accounts (HSAs) have long been one of the most underutilized—but powerful—tax planning tools available. And thanks to the 2025 tax law (yes, the “One Big Beautiful Bill”), HSAs just became even more appealing. These quiet upgrades expand what you can...

Health Savings Accounts (HSAs) have long been one of the most underutilized—but powerful—tax planning tools available. And thanks to the 2025 tax law (yes, the “One Big Beautiful Bill”), HSAs just became even more appealing. These quiet upgrades expand what you can...

If you—or someone you care about—owe back taxes to the IRS, the 2025 tax law includes some much-needed relief. While not every change applies to every situation, these updates can make a real difference for people trying to resolve tax debt without unnecessary stress...

If you—or someone you care about—owe back taxes to the IRS, the 2025 tax law includes some much-needed relief. While not every change applies to every situation, these updates can make a real difference for people trying to resolve tax debt without unnecessary stress...