For years, pass-through entity taxes (PTETs) have been a popular strategy for business owners to get around the $10,000 SALT deduction cap. But with the One Big Beautiful Bill Act (OBBBA) increasing that cap to $40,000 through 2029, you might be wondering—should you...

For years, pass-through entity taxes (PTETs) have been a popular strategy for business owners to get around the $10,000 SALT deduction cap. But with the One Big Beautiful Bill Act (OBBBA) increasing that cap to $40,000 through 2029, you might be wondering—should you...

The IRS is finally catching up with crypto. After four years of work, the agency has finalized new digital asset regulations—and reporting officially begins with your 2025 tax return. Starting next year, custodial crypto platforms such as Coinbase, Kraken, and Binance...

The IRS is finally catching up with crypto. After four years of work, the agency has finalized new digital asset regulations—and reporting officially begins with your 2025 tax return. Starting next year, custodial crypto platforms such as Coinbase, Kraken, and Binance...

Let’s be real—nobody wants to tip the IRS. Instead of paying more than you owe, redirect those dollars back into your business with a few practical moves you can take before December 31. Below are six strategies I recommend to clients when we want to reduce taxable...

Let’s be real—nobody wants to tip the IRS. Instead of paying more than you owe, redirect those dollars back into your business with a few practical moves you can take before December 31. Below are six strategies I recommend to clients when we want to reduce taxable...

Did You Know You Could Turn Your Personal Car into a Business Tax Deduction? If you drive a personal vehicle, there’s a powerful new tax opportunity coming your way in 2025—thanks to the One Big Beautiful Bill Act (OBBBA). This new legislation reinstates 100% bonus...

Did You Know You Could Turn Your Personal Car into a Business Tax Deduction? If you drive a personal vehicle, there’s a powerful new tax opportunity coming your way in 2025—thanks to the One Big Beautiful Bill Act (OBBBA). This new legislation reinstates 100% bonus...

Big changes are coming in 2025—and the new “One Big Beautiful Bill” tax law is packed with updates that could impact nearly every type of taxpayer. Whether you're an employee, business owner, investor, parent, or retiree, there are new ways to save… and new rules to...

Big changes are coming in 2025—and the new “One Big Beautiful Bill” tax law is packed with updates that could impact nearly every type of taxpayer. Whether you're an employee, business owner, investor, parent, or retiree, there are new ways to save… and new rules to...

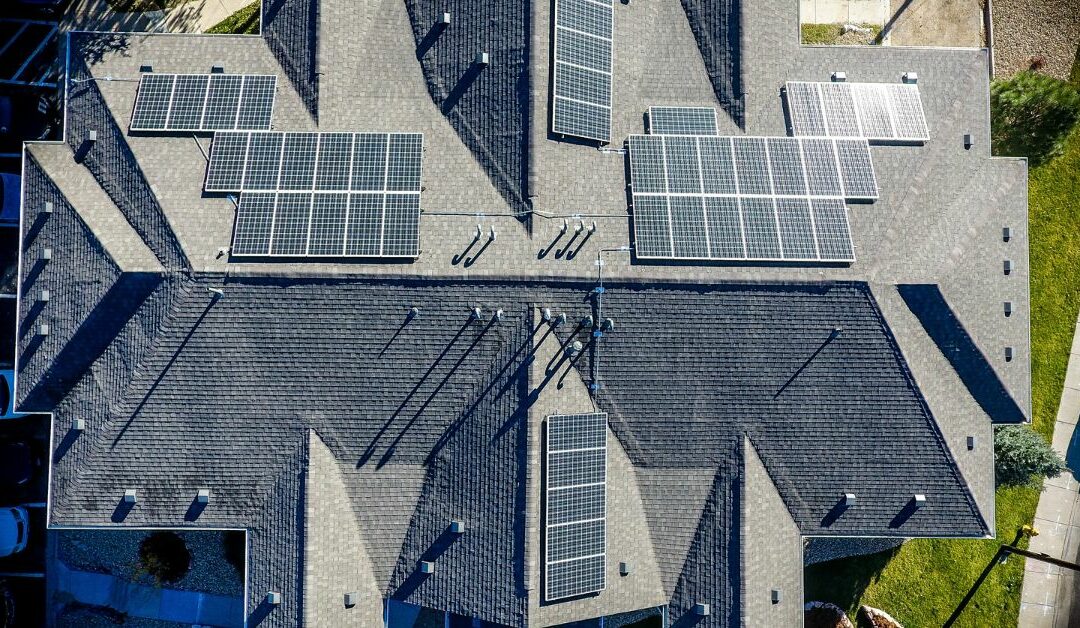

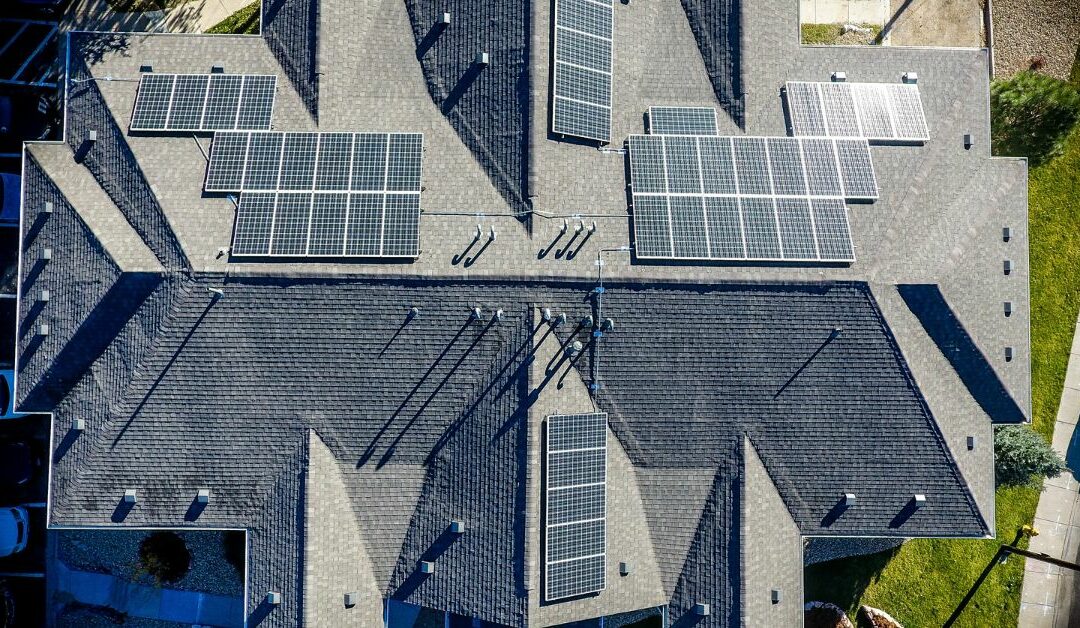

If you’ve been considering solar panels, geothermal heat pumps, or other clean energy upgrades, 2025 might be your last real opportunity to claim the full 30% federal Residential Clean Energy Credit (RCEC). Originally set to phase out gradually through 2034, this...

If you’ve been considering solar panels, geothermal heat pumps, or other clean energy upgrades, 2025 might be your last real opportunity to claim the full 30% federal Residential Clean Energy Credit (RCEC). Originally set to phase out gradually through 2034, this...